Are you running a side hustle or starting a small business? Good idea. You can do this. Let me share with you what I have learned about how to run a side hustle. You can avoid my mistakes!

💥🔫🏃🏽♀️ And you’re off! It feels like a race. You’ve got competitors to beat. Money to make. Goals to achieve. There is so much to do and no team to help do it. It’s just you out there. I’ve been there. But try to slow down a bit.

Running a business is more of a long journey. A race, even a marathon, has a very clear goal. You know when it’s done. Not so with business. Most things to do are ongoing and sometimes it’s hard to know what to focus on. But when you overlook the basics of running your finances, it can cost you money and time down the road.

Here are some tips, and free resources, you can use to skip the headaches I’ve encountered.

Here are 9 mistakes to avoid with your side hustle or small business finances and accounting

One quick note: I live and work in the United States, so my specifics relate to my experience. But these principles can be applied no matter where you live and work.

Mistake #1: Doing it later

Don’t put off getting your side hustle finances in order. The work will just grow and grow. It will become more than you can handle. Instead, keep organized and log things as you go. Then you free up space to focus on your business.

You don’t want tax time to be this giant dumpster fire you’ve been ignoring all year. If you spend a few minutes a day, less than an hour a week keeping everything in order, you’ll be glad you did.

Mistake #2: Not tracking miles

Are you tracking the miles you drive in your car for business? You need to be. You can claim 65 cents per mile. That adds up fast.

That 40 mile drive across town to meet a client or attend a networking event allows you to deduct $26 from your taxable income. Even if you’re almost always at home, you can easily score a few hundred dollars off your taxable income for the miles you drive in your car for your side hustle.

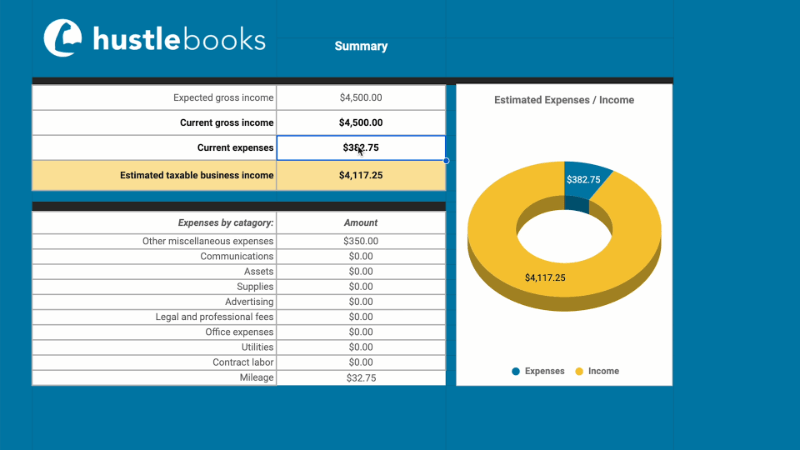

My Spreadsheet-app HustleBooks Pro has a great solution for tracking your miles. It allows you to track trip miles or odometer miles if you want to be fancy. The Hub adds it all up and adds it to your list of annual expenses. It’s easier than making your coffee in the morning. Unless, perhaps, you are specially if you are my coffee-loving copywriting wife, she makes her pour-overs very meticulously.

Whether you use a mile-tracking app, an old skool notebook, or HustleBooks Pro, do track those miles.

Mistake #3: Thinking you can write off lunches by yourself

During the first year of running my own business, I tracked all my trips to Taco Bell and Qdoba. I was all excited. I could save time by not packing a lunch and then deduct my restaurant visits from my taxable income. Nom. Nom. Yes, please! 🌮

Until I met with my accountant. He said, “Oh, you small business owners always get dollar signs in your eyes with your expenses. You can’t do that.”. So, yeah. You can’t write off your coffee trips and meals — UNLESS — you are entertaining a client or networking and talking about work.

But be sure to keep, or snap photos of, those receipts for all meals and coffees at work meetings. You can likely write those off as expenses. Proceed carefully though.

One side note: on taxes and accountants

I haven’t met with that accountant in ten years. Nor any other. No offense to them. But after my second year of running a small business I figured out I could do my finances myself as I built the early versions of what is now HustleBooks!

It takes me maybe 45 minutes to do my business taxes each year using my copy of HustleBoosk Pro (since I open it at least every week) and TurboTax Self-Employed Online. You are strong. You can do the same or something similar for your context.

Mistake 4: Not tracking your time

I know lots of people talk about value-based pricing, instead of time-based pricing. They talk about not trapping yourself into “hourly thinking”. That’s cool. Do that if you can. But I’ve hardly ever had a client who didn’t ask me ‘how many hours will that take?’.

And even with value-based pricing, you should have a secret hourly rate. Secret, meaning you don’t tell your client what it is because you’re charging them by the project and value — not the hours. But it’s the amount you want to be making per hour of work to stay on track with your goals.

So I like to keep a detailed timesheet. I know some hate this kind of thing. I like to be able to look back at April 25th, 2017 and be able to tell you how many hours I spent on which project for which client, and even a bit about what I did. It’s helped me a ton, especially with website work, to be able to go back and see what we did, and why, and how it might have led to the site breaking. 😅

The more organized you are, the freer to be creative you are.

The bottom line is tracking your time, saves time. This is my opinion, feel free to disagree, it just works for me.

Free resource

Here is a blank copy of my Super Timesheet. You can track as much or as little as you want with it. Down to 15-minute blocks. Use it if it helps you.

Mistake #5: Not setting up a business bank account

This one is quick and easy. You’ll find life easier with a separate bank account for your business. It just keeps everything clean and simple. Pay yourself from your work account to your personal account. Then also be sure to leave funds in the account for taxes.

A few years ago I moved from the big bank Chase, over to Relay. Chase started charing me $25/month, and they offer few fancy features. Relay, meanwhile is free, and has all sorts of cool features like easily creating virtual and physical credit cards, with preset spending limits. It’s so cool!

Mistake #6: Incurring too many subscription costs

There are a million SaaS’s (Software as a Service) out there. Most of them are very cool. But be careful. They also come with those never-ending monthly subscription costs. They add up. And do you need them all? Do they really make you more productive?

I run my business, right now, with three SaaS’s:

- Google Drive. Free. ✅ (which I used to run my HustleBooks Spreadsheet-app)

- HustleBooks Pro. Free. ✅ (cuz I made it, for you a one-time cost of $49, or try HustleBooks Starter free forever)

- Basecamp Personal. Free. ✅

- Notion. Free. ✅

I’m tempted to use so many more. SaaSs and apps are cool. Fun to try out. They make you feel productive and like a super-rad business owners. But they can be a distraction. For a side hustle, all you need is Spreadsheet-apps and DIY grit.

HustleBooks is an alternative to never-ending software subscription costs. I have a full-time day job right now. I might go two months without doing a side project. The last thing I want to do is pay money every month for something I don’t use.

Mistake #7: Not getting a deposit first

Don’t start the project until you get a 50% deposit, or in some cases a 25% deposit. It depends on the client and project size sometimes.

You and your client need to be building trust. And this is the biggest way they show trust. You’ve already likely spent time doing discovery and project planning. They should respect your time enough to pay a significant amount of the money upfront.

Pro tip

Don’t spend the deposit money until you complete the project, if possible. Hold it in your business bank account. I’ve always considered deposit money not quite yet mine — even though it’s not quite theirs anymore either. It’s in between, or in the finance world in escrow (except you are serving as the ‘third’ party). Hold on to it and don’t spend it, just in case something unexpected happens.

Mistake #8: Not saving for taxes

When you get paid for a gig or a project with your side hustle or small business, remember that income will be taxed. No one is setting aside money for taxes like they do when you’re an employee. Someone has to pay taxes on that income, and that person is you.

If you miss this, it will wreak havoc on your side hustle finances or accounting.

In the USA it’s best to set aside 30% (some say 40%) of what you make for taxes. I know. That’s no fun. Plan that into your costs of doing business. When you sit down to do taxes each year, you’ll likely have to pay less than that based on some of the expense deductions we’ve been discussing. But, you want to be ready for the worst.

HustleBooks Pro has a great expense tracker. I’ve used it for years. Every time I purchase something work-related, I quickly jot down the date, amount, and item of the expense. HustleBooks Pro has expense categories that align with the categories on an IRS tax return (United States). Works like a charm.

When you get that first big check, it’s tempting to go reward yourself with a big purchase. But remember, some of that money is just not yours. It’s the government’s money. Life. 🙄

If you get into debt with the IRS it can ruin things for your business. You don’t want to spend your valuable time on that. Just spend a few seconds setting money aside each time you get paid.

This tax stuff is complicated and too big of a topic for this article. Here is a great resource from Dave Ramsey, the king of getting and staying out of debt.

Mistake #9: Not saving for yourself

It’s no fun saving money to pay the government. But one day it will be fun to spend the money you saved for yourself or for you and your loved ones. The trick is to start saving today.

Luckily, I don’t have a sad story to share here. I didn’t have to learn this the hard way. When I was self-employed someone told me to put as much money as possible into a Simple IRA. I did. I put the maximum amount of money into it during the two years I worked full-time for myself. Here’s what happened:

- Both years it significantly reduced my taxable income, I paid less taxes!

- I never put money in it again, because I got a full-time job.

- Despite the ups and downs of the stock market, despite that time in 2009 where it went down by 50%, there is now 5 times the money in there than I put in it.

There are two tricks to saving money:

- not spending more than you have

- second, putting that money into some sort of investment or retirement account that has a chance to grow.

The sooner you do it, the more time it has to grow. So you’ll hear it everywhere, and it’s true: start saving today — even if it’s just a little bit.

Ok. That’s it!

Ok. That’s it! Those are the 9 things I’ve learned about running your side hustle finances.

Be sure to take a look at our free HustleBooks Starter. It’s a free forever Spreadsheet-app and 5-minute video course to show you how to quickly start running your side hustle. Take control of your finances.

More Resources:

Photos from Unsplash:

- Money by: Live Richer on Unsplash

- Television by: freestocks on Unsplash

- Tacos by: Obi Onyeador on Unsplash